- BUDGET PLANNING WORKSHEETS PRINTABLE HOW TO

- BUDGET PLANNING WORKSHEETS PRINTABLE CODE

Making A Budget: This worksheet lets students pick a “roommate” to keep costs down, enter entry-level job numbers, and develop a plan for the future.

BUDGET PLANNING WORKSHEETS PRINTABLE HOW TO

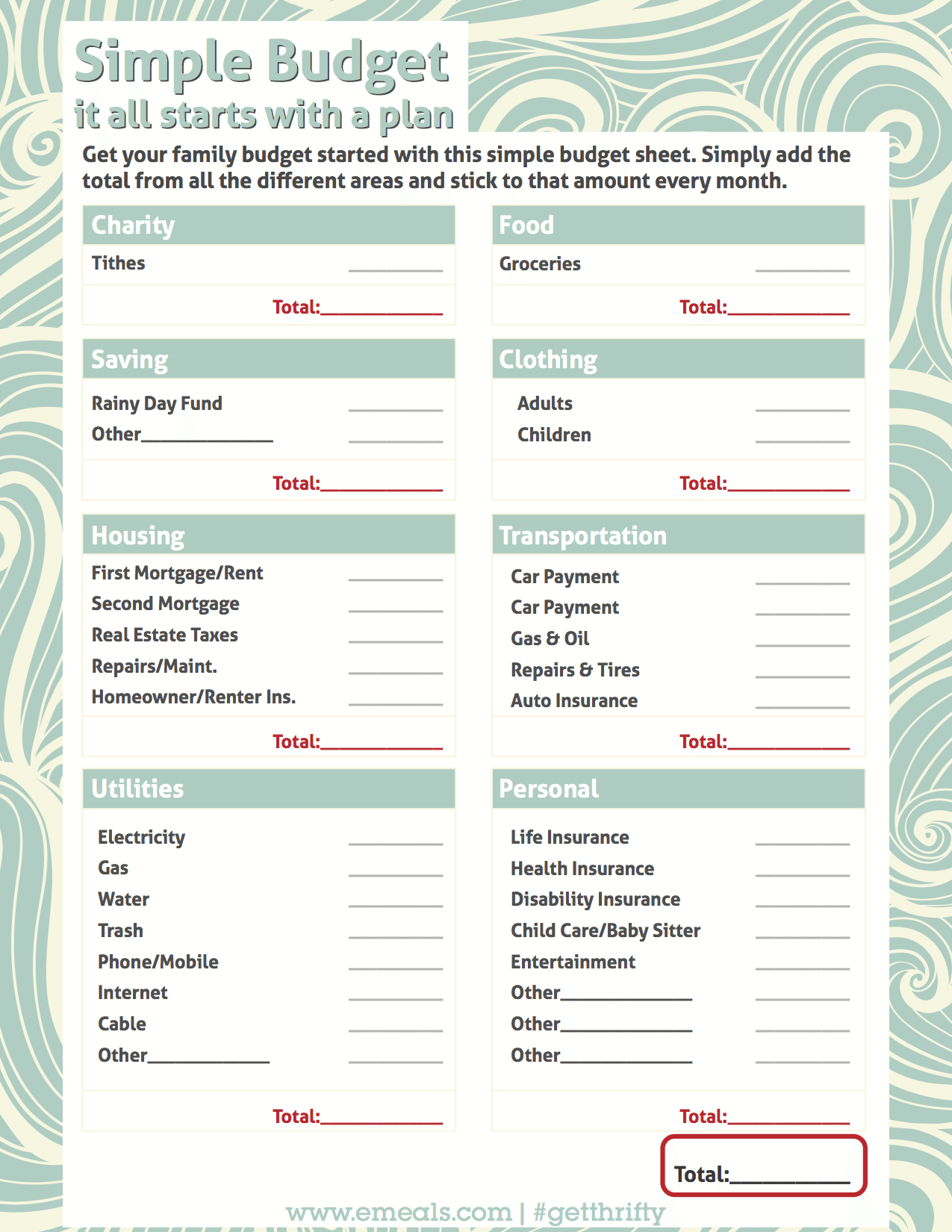

Monthly Budget: This worksheet splits expenses into categories so that students understand the main spending areas and how to budget for them. Teen Budget Worksheet: This worksheet shows kids how to input income and expenses and automatically performs the calculations for them. Budget Busters: Students analyze a case study in this worksheet to see how the sample budget could be fixed and then use percentages to calculate their budgets.  My Own Budget: Students develop their unique budgets in this worksheet, representing their expenses and income as percentages in pie charts and lists. Budgeting Your Money: This worksheet is part of a broader lesson and has students track their income and expenses over a month to see how they spend. They can use this data to form their budgets and see how careful planning is essential.

My Own Budget: Students develop their unique budgets in this worksheet, representing their expenses and income as percentages in pie charts and lists. Budgeting Your Money: This worksheet is part of a broader lesson and has students track their income and expenses over a month to see how they spend. They can use this data to form their budgets and see how careful planning is essential.

High schoolers may already have an income or know the potential numbers they can plug in for future careers. Budgeting For A Fun Day With A Friend: This worksheet breaks down a single day’s budget, showing students that they can adjust their plans and create budgets for various time periods.

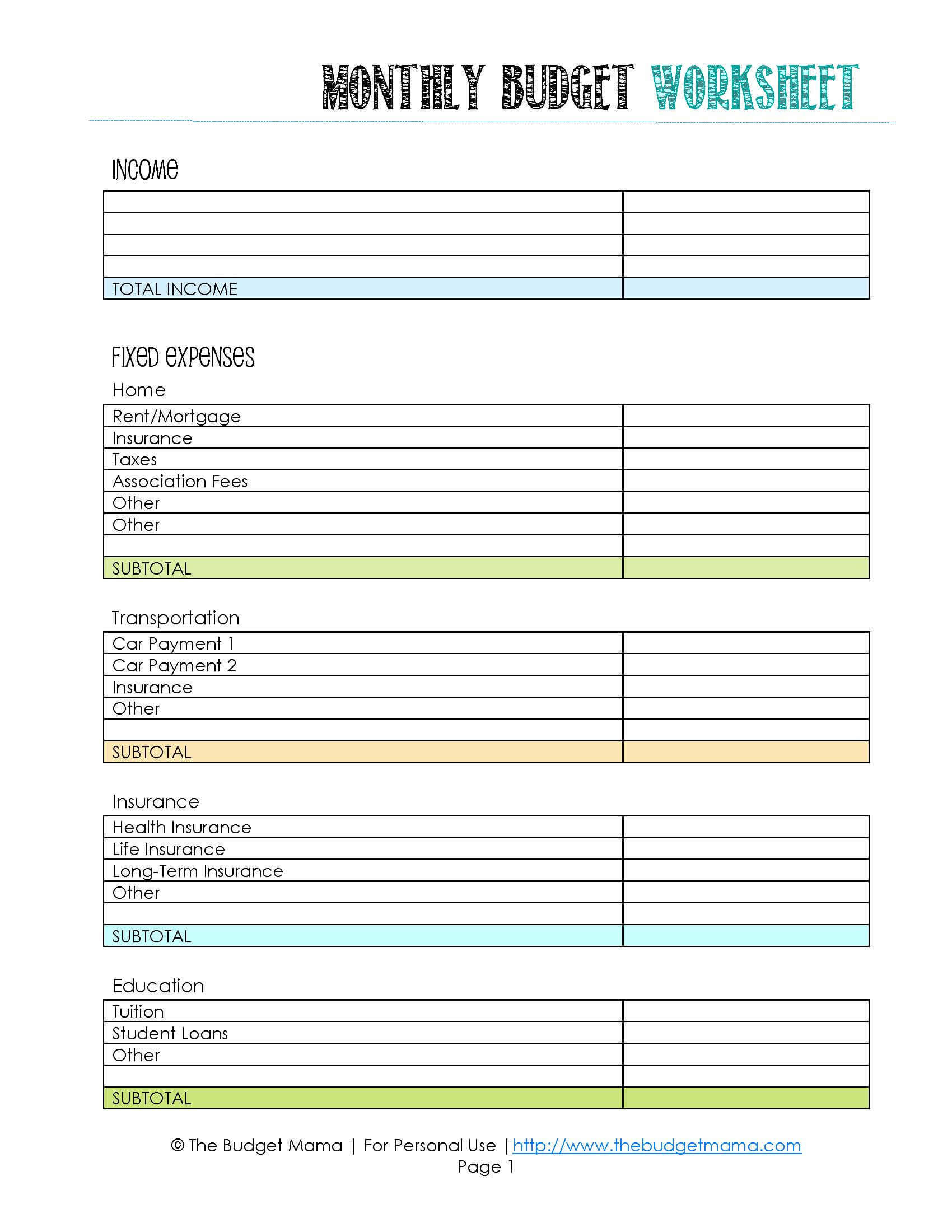

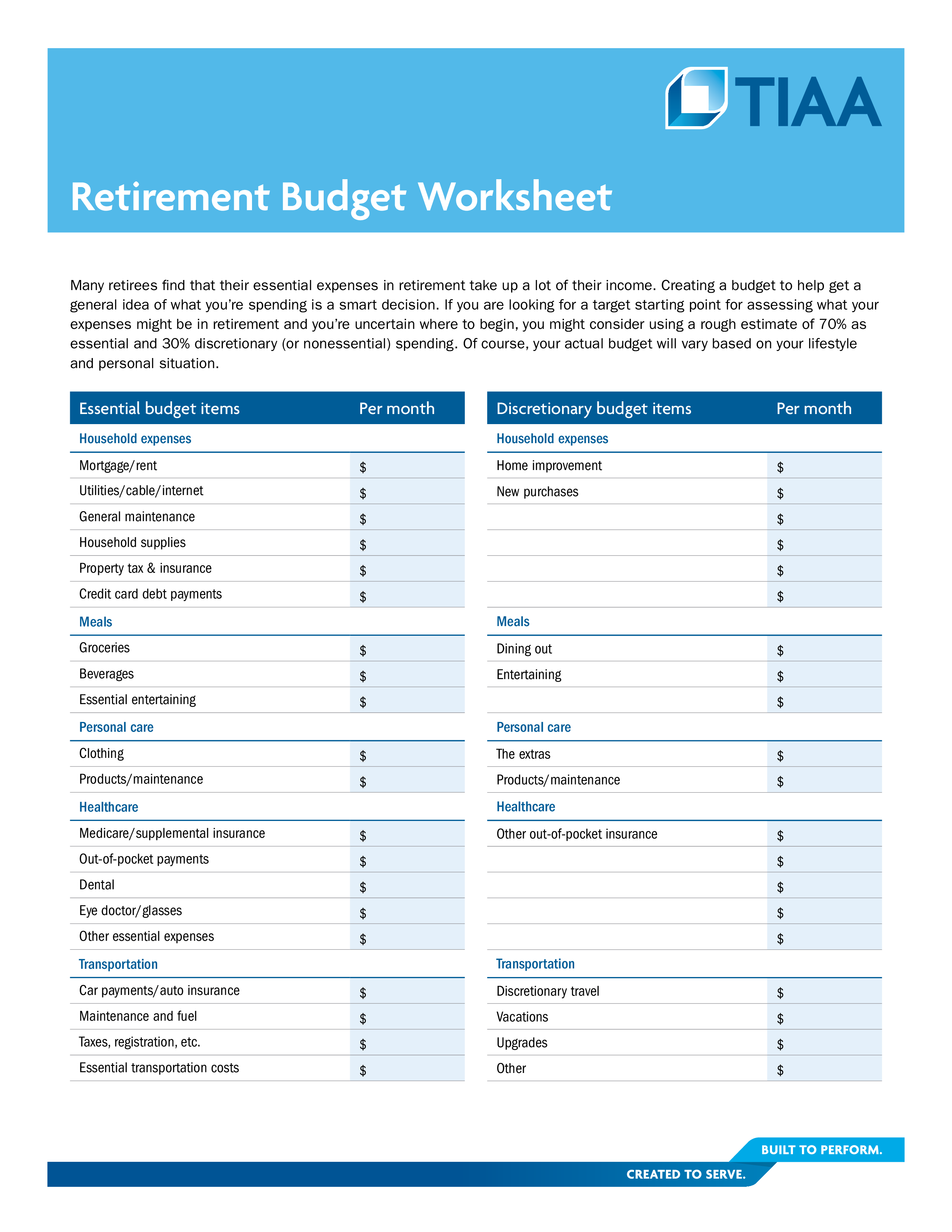

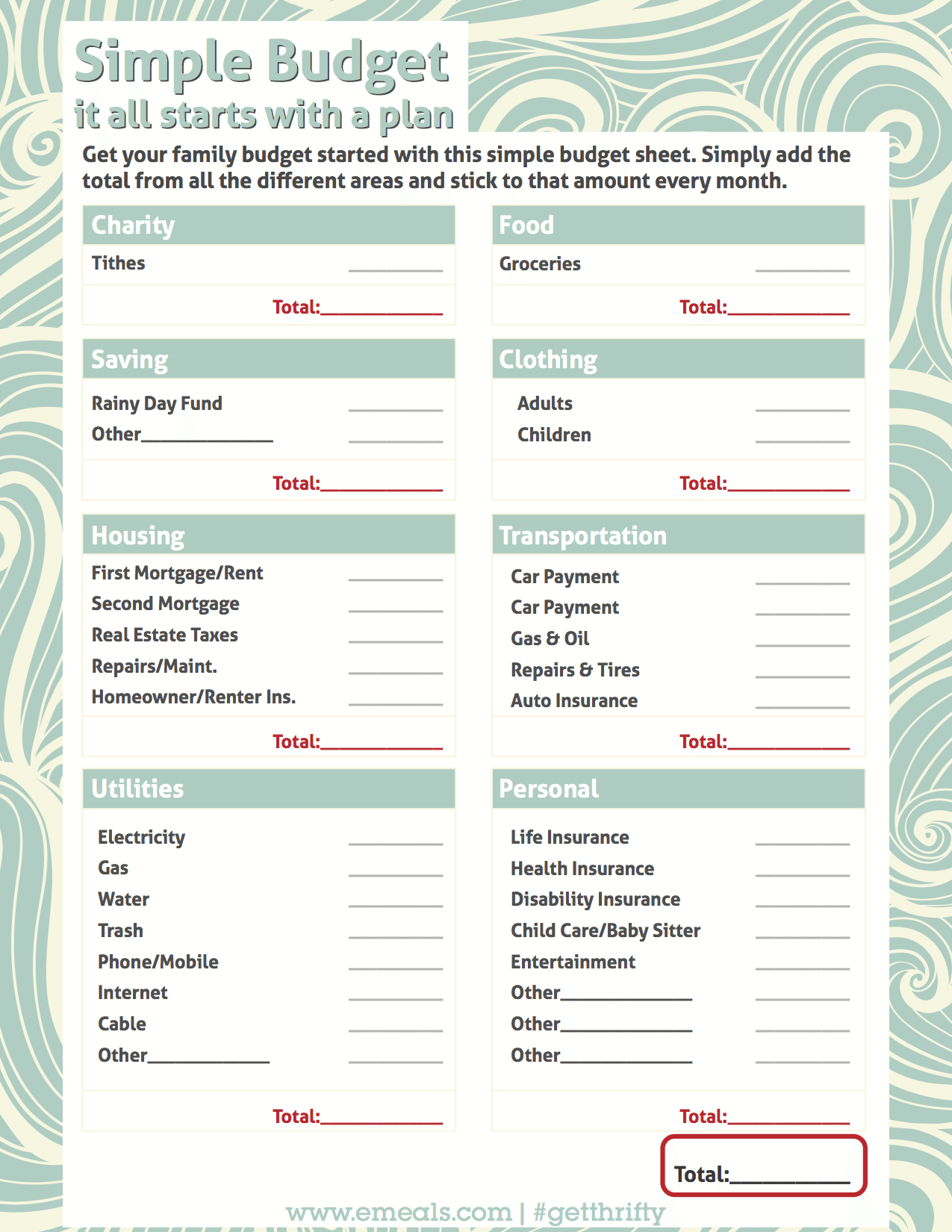

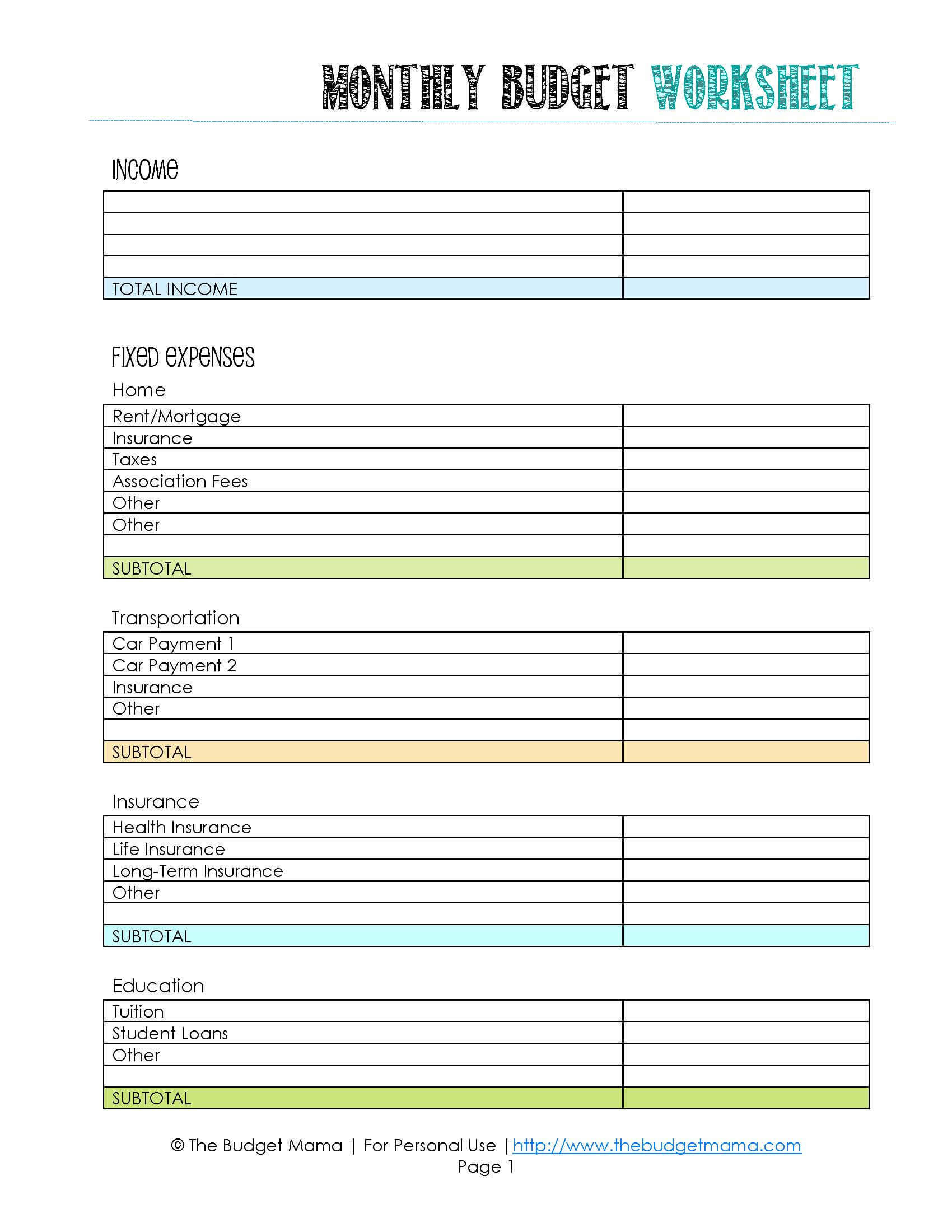

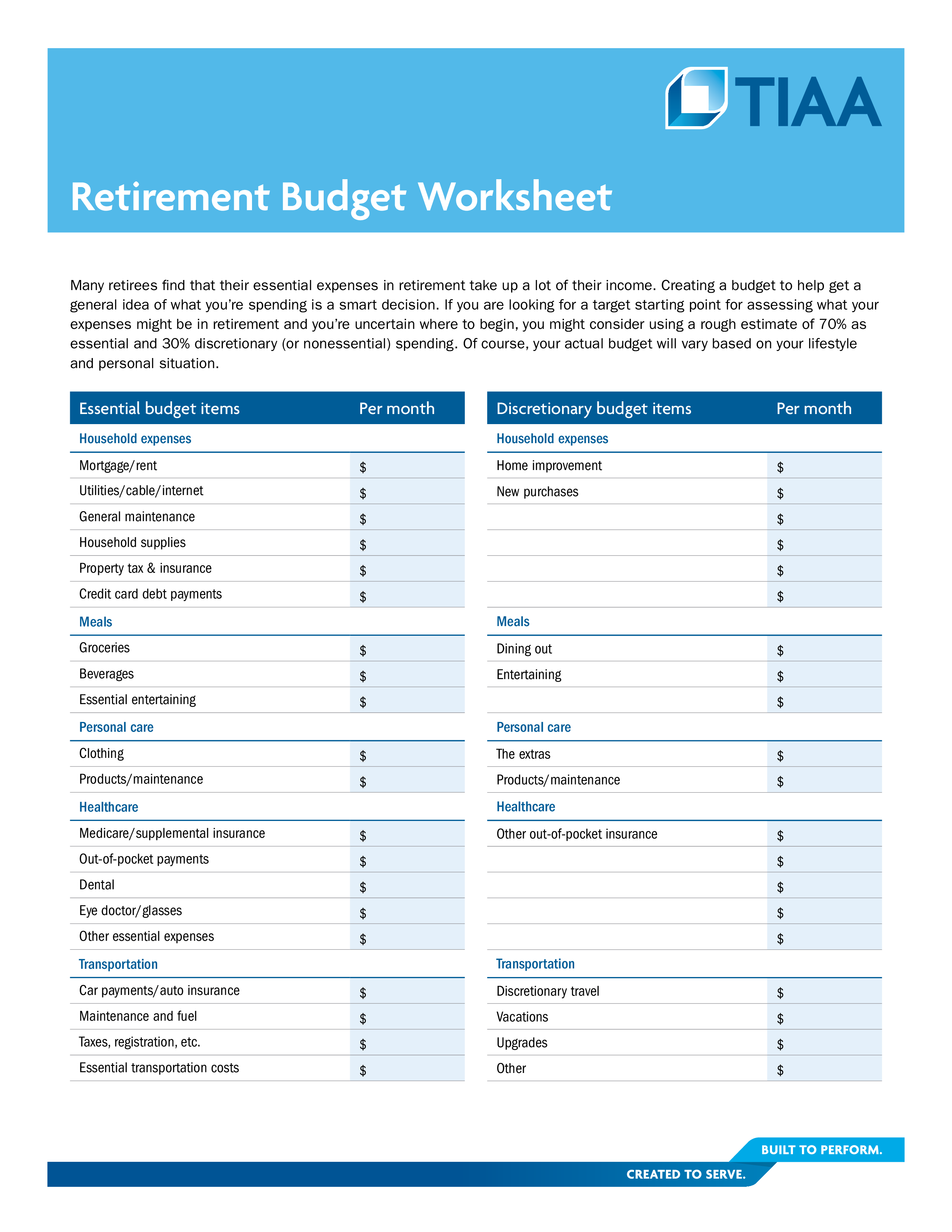

Monthly Budget Worksheet: This worksheet lets students plan their budgets or plug in numbers to a sample budget to see how the process works (scroll to the bottom for the worksheet). The Art of Budgeting: In this extensive worksheet, students need to list various goals, understand how a hypothetical spender budgets, and create their own budgets. Budget Basics: This worksheet includes a scenario that shows students how to budget for a specific purchase (a car) and how to break savings down monthly. Kid’s Money Budget Worksheet: This worksheet provides students with an intuitive and user-friendly interface, helping them become expert budgeters. Middle school children can learn money-saving strategies to keep sample budgets in line. Christmas Budget: This worksheet shows students a specific way to budget and track costs, using holiday gifts as an example. Financial Logs For Kids: This worksheet pack gives kids three ways to track their budgets and shows them the different components involved in planning monthly. Save, Spend, Share Worksheet: This budgeting worksheet for kids tracks the amounts they put into their Save, Spend, and Share jars, showing them a direct connection between money and budgets. Monthly Budget Worksheet For Kids: This worksheet is excellent for young students to give them a basic idea of how a budget works, with only a few rows to fill out. Build Your Own Budget: This worksheet breaks down costs into wants and needs and includes a section on long-term goals. Your younger students can understand how budgets work and apply that knowledge with these worksheets. Here are the best budgeting worksheets for students. Teachers and homeschoolers will encounter a variety of resources to teach this concept, but worksheets are a proven way to give your kids hands-on, practical experience.

Monthly Budget Worksheet: This worksheet lets students plan their budgets or plug in numbers to a sample budget to see how the process works (scroll to the bottom for the worksheet). The Art of Budgeting: In this extensive worksheet, students need to list various goals, understand how a hypothetical spender budgets, and create their own budgets. Budget Basics: This worksheet includes a scenario that shows students how to budget for a specific purchase (a car) and how to break savings down monthly. Kid’s Money Budget Worksheet: This worksheet provides students with an intuitive and user-friendly interface, helping them become expert budgeters. Middle school children can learn money-saving strategies to keep sample budgets in line. Christmas Budget: This worksheet shows students a specific way to budget and track costs, using holiday gifts as an example. Financial Logs For Kids: This worksheet pack gives kids three ways to track their budgets and shows them the different components involved in planning monthly. Save, Spend, Share Worksheet: This budgeting worksheet for kids tracks the amounts they put into their Save, Spend, and Share jars, showing them a direct connection between money and budgets. Monthly Budget Worksheet For Kids: This worksheet is excellent for young students to give them a basic idea of how a budget works, with only a few rows to fill out. Build Your Own Budget: This worksheet breaks down costs into wants and needs and includes a section on long-term goals. Your younger students can understand how budgets work and apply that knowledge with these worksheets. Here are the best budgeting worksheets for students. Teachers and homeschoolers will encounter a variety of resources to teach this concept, but worksheets are a proven way to give your kids hands-on, practical experience. BUDGET PLANNING WORKSHEETS PRINTABLE CODE

I use highlighters to color code the items on this tracker.Budgeting is a critical skill in personal finance, and the more practice your students get in making a budget, the better. There are 3 months on each page with dates from 1 to 31. Quarterly log (NEW!) – This is what I personally use to keep track of my bills and other things. Notes – These are blank pages so you may personalize your planner by drawing charts or adding more lists, like meal plans, grocery list or construction expenses. (I only list down unplanned expenses because I already have a bills calendar for my planned expenses.) (My categories now are savings, insurance, taxes, rent, groceries, and bills.)īills and expenses tracker – Keep track of your bills due and daily expenses. The categories chart is where you list down money for savings, sinking funds, rent and other expense categories. (The rest of our money are on our other savings accounts so I don’t overspend.)īudget planner – This is where I plan my budget for the month.

This helps me check if I have just enough available balance on my credit card or debit card for that week. I write down the monthly bills due for each day and other regular expenses like groceries or dog food. Monthly bills calendar – Each month has a unique floral theme. Future log – I use this for listing down annual and quarterly bills and major celebrations that require more than usual spending.

0 kommentar(er)

0 kommentar(er)